Canopy: Simplifying Tax Reporting, Saving Millions

Automating transaction tracking and CRS compliance in minutes, not weeks.

Ever stared at a statement with thousands of stock trades and felt your brain go numb?

For anyone managing hundreds of securities and accounts, the reality is familiar: tracking costs, tallying gains and losses, and preparing for tax filings isn’t just tedious—it’s a minefield for errors.

One wrong formula, one missing trade, and suddenly compliance risk (and long weekends of manual corrections) is staring you in the face.

The Hidden Cost of Manual Tracking

Most finance teams and individual investors still rely on bank statements or Excel. The problem?

🏦 Bank statements show only cash flows—not the granular trade-level details.

💲 Fees, commissions, and dividends often get lost in the shuffle.

🖊️ Reconstructing trades manually is time-consuming, inconsistent, and leaves you vulnerable to mistakes.

Now layer on the Common Reporting Standard (CRS), adopted by over 100 jurisdictions, and compliance shifts from a tedious task to an overwhelming challenge without the right tools.

The CRS Challenge: Manual, Time-Consuming, Risky

CRS reporting requires:

💼 Every taxable gain/loss reported per trade (no netting allowed)

🌍 Jurisdictional accuracy — especially across international holdings

🔍 Audit-traceable details — dates, prices, fees, dividends must align

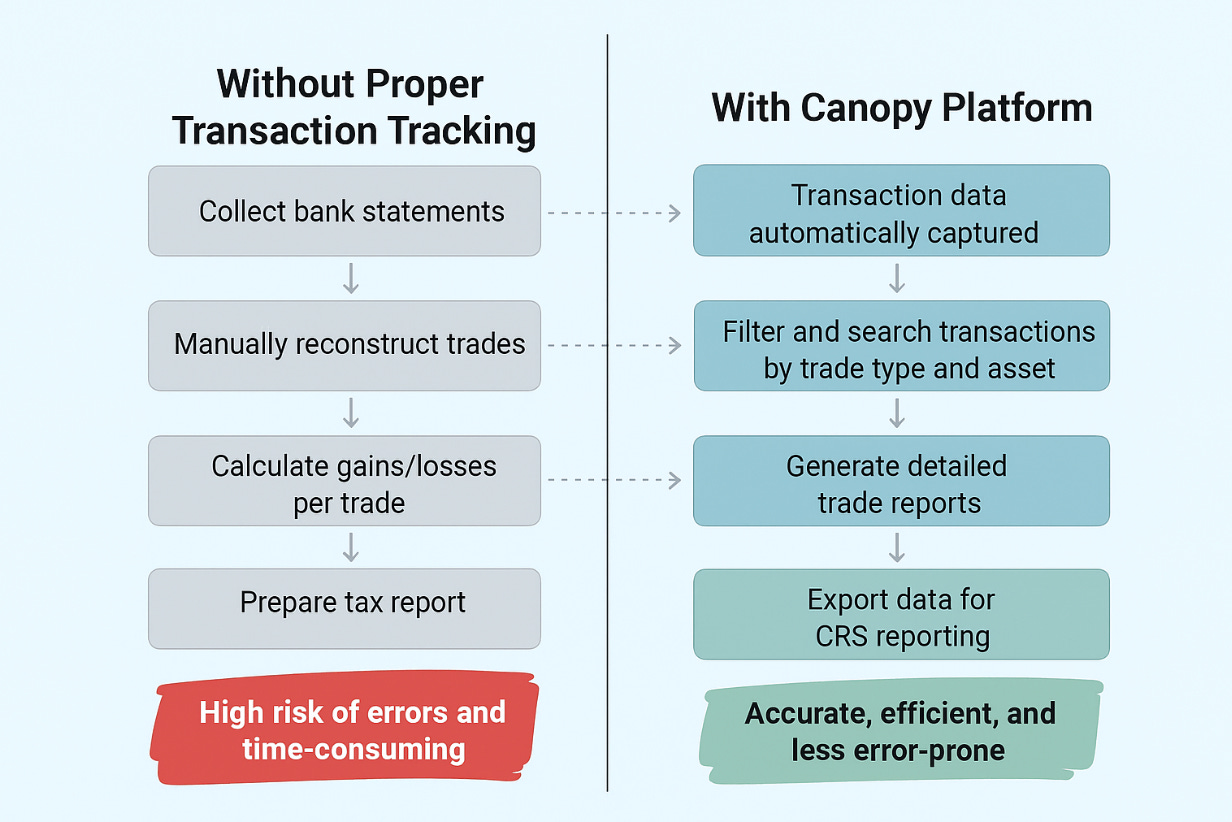

Yet without transaction-level data, the process looks like this:

🔢 Dig through PDF statements for relevant entries

✍️ Manually reconstruct each trade, including prices, dates, and fees

⚖️ Manually calculate gains/losses per trade

✉️ Prepare tax reports

This tedious process not only consumes time, but also increases the risk of filing errors and regulatory scrutiny — especially when portfolios span multiple accounts, securities, and jurisdictions.

The Solution: Canopy’s Smart CRS-Ready Transaction Engine

Instead of combing through thousands of line items, Canopy provides:

📂 A single source of truth: complete transaction histories across multiple securities and accounts.

📊 Automated accuracy: costs, realized gains, and losses calculated for you—no formulas, no guesswork.

⚡️ Powerful filters: search by date, security, or portfolio in seconds.

💾 Export-ready compliance: seamlessly exporting of data for tax filings and other reporting requirements

With Canopy, a process that used to take weeks can now be completed in minutes to be accurate, efficient and less error-prone!

Case Study: From a Full Workweek to 15 Minutes

A family office accountant supporting a HNWI with active trading across multiple platforms used to spend a full workweek just gathering data—manually downloading monthly statements, scanning for trades, rebuilding every transaction, and then calculating gains/losses one by one.

After switching to Canopy, the same task took under 15 minutes. All trades were already captured, structured, and categorized. The accountant simply filtered by date, selected a reporting format, and exported a complete CRS-ready report.

That’s a 10x+ efficiency gain, fewer errors, and peace of mind during tax season.

Why It Matters Now

CRS and tax authorities are stepping up enforcement, sharing data globally, and detecting undeclared income more efficiently than ever. Relying on bank statements or manual Excel work isn’t just inefficient—it’s risky.

Canopy eliminates this gap by providing:

✅ Accuracy: verified trade-level data

⏱️ Time saved: 1 week → 15 minutes

🔐 Security: encrypted, role-based access

📊 Clarity: instant portfolio-wide visibility

Whether you're an advisor, trustee, family office CFO, or an end-client preparing your own filings—Canopy turns a regulatory burden into an operational edge.

Video Demo: See Canopy in Action

Watch this short demo to explore how our platform automates transaction capture, gain/loss calculations, and CRS-ready reporting.

Ready to Replace Spreadsheets with Smart Reporting?

Explore how Canopy can simplify your next CRS cycle.

Canopy — Turn complexity into clarity. Transform tax compliance into strategic power.